State-Level Direct Selling Monitoring Mechanisms in India

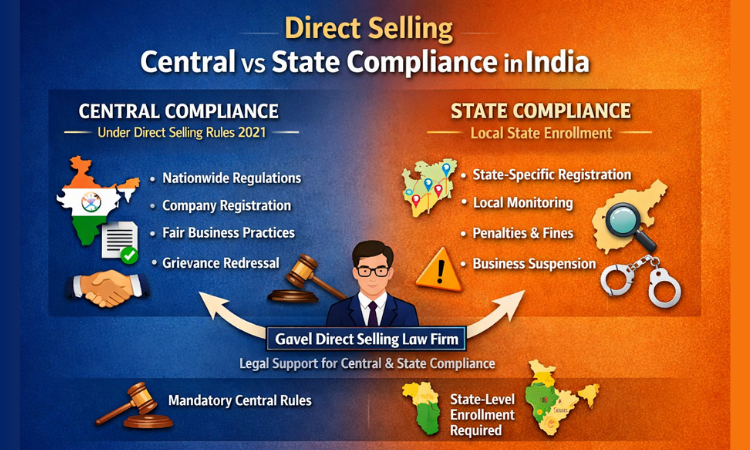

Direct Selling Central vs State Compliance in India

What Direct Selling Companies and Direct Sellers Must Know

The direct selling industry in India has seen rapid growth in recent years. With thousands of direct selling companies and lakhs of direct sellers operating nationwide, legal compliance has become critical. While the Direct Selling Rules, 2021 provide a central framework, several states have introduced state-level monitoring mechanisms. Understanding the difference between central and state compliance is vital for any direct selling company or direct seller to operate legally and avoid penalties.

Central Compliance under Direct Selling Rules 2021

The Department of Consumer Affairs issued the Direct Selling Rules, 2021, to regulate all direct selling companies in India. These guidelines apply to every direct selling company and direct seller, regardless of the state of operation. Key requirements include:

-

Registration of the direct selling company under Companies Act, 2013.

-

Maintaining transparent direct selling agreements with direct sellers.

-

Ensuring fair practices in product promotion and compensation plans.

-

Providing grievance redressal mechanisms for direct sellers and customers.

Compliance with these central rules is mandatory for all direct selling companies and all direct sellers in India. Even if a company is compliant at the state level, failure to follow central guidelines can attract legal action.

Why Central Compliance Matters

For any direct selling company, central compliance ensures credibility, trust, and protection under the law. For direct sellers, central compliance guarantees fair business practices, timely commission payments, and legal support. Companies not following central compliance risk penalties, suspension, and reputational damage, which can severely affect direct sellers dependent on their business.

State-Level Compliance: The Need for Local Enrollment

While central compliance governs the overall framework, some states have gone a step further by introducing direct selling monitoring mechanisms. These mechanisms require both direct selling companies and direct sellers to submit applications and enroll with the state authority before conducting business.

Currently, states with mandatory monitoring include:

-

Andhra Pradesh – Mandatory enrollment for companies and direct sellers under Andhra Pradesh Direct Selling Guidelines, 2022.

-

Goa – Submission of company and direct seller registration to operate legally.

-

Maharashtra – State-level registration recommended; non-compliance can lead to penalties.

-

Mizoram, Kerala, Haryana, Meghalaya, Nagaland, Tamil Nadu, West Bengal, Rajasthan – All require direct selling companies and direct sellers to enroll before operating.

Failure to comply with state submission requirements can result in business suspension, fines, or legal prosecution.

Direct Selling Company vs Direct Seller Compliance

It is important to distinguish the compliance obligations:

Direct Selling Company:

-

Must ensure central registration and adherence to the 2021 guidelines.

-

Must enroll in state monitoring mechanisms wherever mandatory.

-

Must maintain records of direct sellers, agreements, and commissions.

Direct Seller:

-

Must register with the state authority if required.

-

Must work only with legally compliant direct selling companies.

-

Should maintain records of commissions, sales, and agreements for legal protection.

Importance of State Submission

State submission is not just a bureaucratic formality. It:

-

Provides legal protection to direct sellers.

-

Ensures direct selling companies operate transparently.

-

Prevents unauthorized or illegal business operations in the state.

-

Helps regulators monitor the industry effectively and curb fraudulent schemes.

For example, in Andhra Pradesh, any direct selling company operating without state enrollment can face immediate suspension, even if it is compliant under central guidelines.

Consequences of Non-Compliance

Non-compliance with either central or state rules can have serious consequences:

-

Penalties and fines imposed on the company.

-

Suspension of operations in the state.

-

Legal action against direct selling companies and even individual direct sellers.

-

Loss of trust among consumers and direct sellers, impacting business growth.

Gavel Direct Selling Law Firm emphasizes that compliance is not optional—it is the foundation of a sustainable direct selling business in India.

How Gavel Direct Selling Law Firm Supports Companies

Gavel Direct Selling Law Firm provides end-to-end legal support for direct selling companies and direct sellers:

-

Ensuring central guideline compliance.

-

Managing state-level enrollment in states like Andhra Pradesh, Goa, Maharashtra, Tamil Nadu, West Bengal, and others.

-

Drafting direct selling agreements and policies.

-

Assisting in grievance redressal mechanisms for companies and direct sellers.

Gavel Direct Selling Legal Expert advises that proactive compliance helps direct selling companies avoid penalties, gain trust, and scale operations legally.

Best Practices for Direct Selling Companies and Direct Sellers

-

Always verify state-specific rules before launching operations.

-

Maintain updated records of direct sellers and their commissions.

-

Ensure transparent agreements with direct sellers.

-

Seek guidance from legal experts like Gavel Direct Selling Law Firm to handle both central and state compliance efficiently.

Key Takeaways

-

Central compliance under Direct Selling Rules, 2021 is mandatory nationwide.

-

States like Andhra Pradesh, Goa, Maharashtra, Mizoram, Kerala, Haryana, Meghalaya, Nagaland, Tamil Nadu, West Bengal, and Rajasthan require direct selling state-level enrollment.

-

Both direct selling companies and direct sellers must comply to operate legally.

-

Non-compliance can lead to penalties, business suspension, and legal action.

-

Partnering with a reliable legal firm like Gavel Direct Selling Law Firm ensures complete compliance and protection.

Conclusion

The growth of India’s direct selling industry depends on legal compliance and transparency. For direct selling companies and direct sellers, understanding the difference between central and state compliance is critical. While central compliance provides a nationwide framework, state submissions ensure legal operations in specific states.

Companies must prioritize compliance not just as a legal requirement but as a strategic advantage. Direct sellers, on the other hand, must ensure they work only with compliant companies to protect their business and earnings.

Gavel Direct Selling Law Firm recommends that every direct selling company and direct seller adopt a proactive compliance approach—central and state-level—to grow sustainably in India’s booming direct selling industry.

.png)